ULIPs present everyday living insurance coverage coverage in conjunction with investment Added benefits. Inside the party of your policyholder's untimely demise, the nominee gets the sum assured or the fund benefit, whichever is increased.

Although each and every care has long been taken within the preparation of the content, it truly is issue to correction and markets might not perform in an analogous manner based on factors influencing the capital and personal debt marketplaces; for this reason this advertisement will not individually confer any lawful legal rights or duties.

The customer is encouraged to refer the specific income brochure of respective specific items talked about herein before concluding sale.

The Term Booster6 is an extra aspect that boosts the protection of the coverage. If your lifetime insured is diagnosed which has a terminal health issues, they'll obtain 10% from the sum assured underneath the life insurance plan.

Investments are subject matter to industry risks. The business isn't going to promise any certain returns. The investment cash flow and price tag may possibly go down along with up according to a number of factors influencing the market.

In ULIP, a portion of the quality paid out through the policyholder is employed for lifetime coverage protection, although the remaining amount is invested in many equity, personal debt or balanced funds as per the policyholder's desire.

$The premium paid out in Device Linked Everyday living Insurance policies procedures are topic to investment threats connected with funds marketplaces and also the NAVs on the models may perhaps go up or down according to the effectiveness of fund and things influencing the cash marketplace along with the insured is chargeable for his/her conclusions.

It will seek to speculate in companies with similar weights as during the index and deliver returns as carefully as you can, topic to tracking mistake.

Tata AIA Daily life Insurance provider Ltd. doesn't believe obligation on tax implications mentioned anyplace on this site. Please speak to your very own tax advisor to grasp the tax Gains available to you.

The objective of this Fund should be to produce cash appreciation in the long term by investing in a diversified portfolio of companies which would take advantage of India’s Domestic Intake expansion story.

and AIA Company Confined. The assessment underneath the wellness software shall not be regarded as a clinical tips or even a substitute to the consultation/cure by an experienced medical practitioner.

This isn't an investment guidance, be sure to make your own impartial choice after consulting your economical or other Expert advisor.

The efficiency Retirement asset protection companies on the managed portfolios and cash will not be certain, and the value could boost or lower in accordance with the future expertise from the managed portfolios and funds.

*Profits Tax Rewards could be available According to the prevailing revenue tax legal guidelines, subject matter to fulfilment of click here now problems stipulated therein. Revenue Tax regulations are issue to alter every so often.

The Wellness$$ Software is predicated on points you can make by completing on the net well being assessments and by Assembly daily and weekly physical action aims.

ULIP stands for Unit Linked Insurance plan Plan, which can be a variety of insurance solution that combines the benefits of existence insurance policies and investment in only one approach.

The maturity gain presented below this policy is the full fund worth of your investment at 4% or eight%, as maturity7 total together with loyalty additions along with other refundable rates, combined with the return of each of the premiums compensated in direction of the Tata AIA Vitality Shield Progress daily life insurance policy policy.

Price cut is driven by accrued factors which is attained as a result of wellness status. Make sure you refer coverage doc For additional aspects.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Amanda Bearse Then & Now!

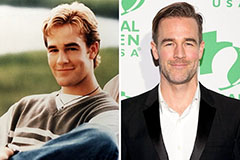

Amanda Bearse Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Tonya Harding Then & Now!

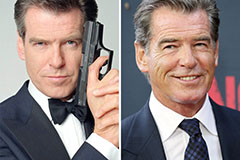

Tonya Harding Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!